Highlands Coffee began operations in 1999 as a packaged coffee brand, initially focusing on high-quality roasted and ground coffee products, before later engaging in various collaborations with the Philippines-based Jollibee brand.

According to the third-quarter 2025 financial report of Jollibee Foods Corporation (JFC) of the Philippines—the parent company of Highlands Coffee—Vietnam’s largest coffee chain continued to set a new profit record.

Specifically, EBITDA profit for the quarter reached approximately PHP 666 million, equivalent to more than VND 297 billion. This marked the highest level in the past two years and represented a 17.1% increase year-on-year. The third quarter of 2023 was the first time JFC disclosed Highlands Coffee’s figures separately in its financial statements.

Cumulatively for the first nine months of 2025, Highlands Coffee recorded EBITDA of approximately PHP 1,909 million (equivalent to VND 852 billion), up 9.5% compared with the same period last year. The chain contributed nearly 29% of EBITDA from JFC’s coffee and tea segment and accounted for 6.1% of the group’s total EBITDA.

As of the end of September 2025, Highlands Coffee operated 928 stores, an increase of 78 outlets compared with the end of the previous year, including 800 company-owned stores and 128 franchised locations.

Highlands Coffee was founded by entrepreneur David Thai (Thai Phiep Diep) and began operations in 1999 as a packaged coffee brand specializing in high-quality roasted coffee. After its roasted coffee products were well received, Highlands Coffee opened its first café in Ho Chi Minh City in 2002.

Ten years later, in 2012, Jollibee Foods Corporation acquired Highlands Coffee through a transaction with Viet Thai International Group (VTI Group), a company founded by David Thai.

Notably, in mid-2025, VTI announced a change to its business registration, showing that the company’s charter capital stood at VND 326.6 billion. This represented a shift from 100% domestic private ownership to a structure comprising 73% private capital and 27% foreign capital.

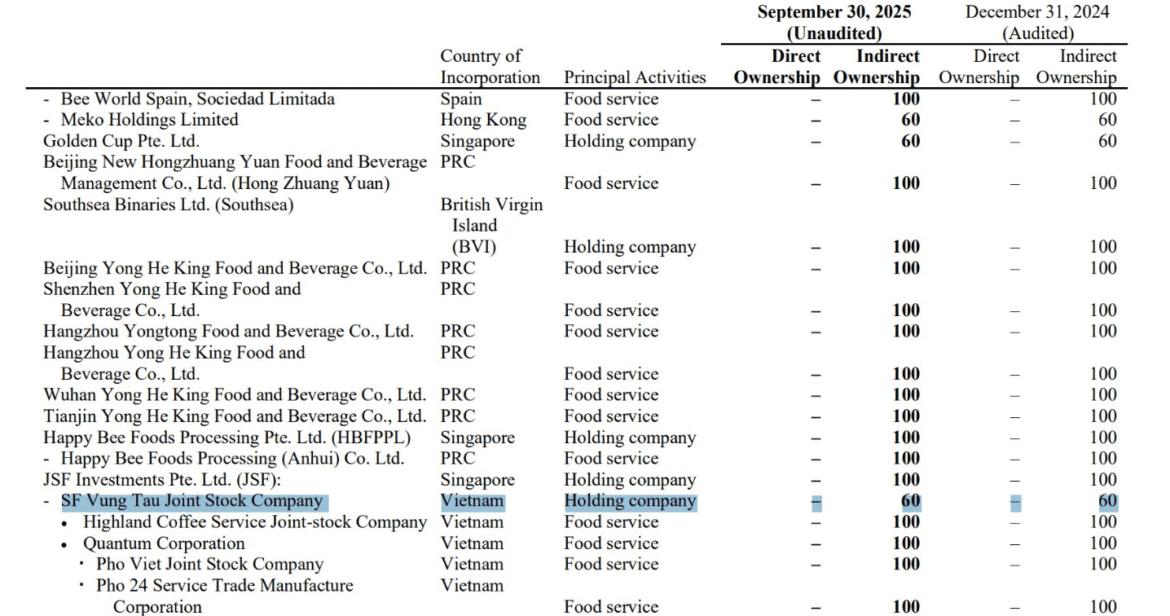

In addition, according to Jollibee Foods Corporation’s reports, the Philippine conglomerate currently holds a 60% stake in SF Vung Tau JSC, the company that owns 100% of Coffee Highlands Service JSC—the entity operating the Highlands Coffee chain.

At the end of 2015, a business registration update by SF Vung Tau indicated that its charter capital increased from VND 19.9 billion to VND 53.1 billion. Along with this change, domestic private capital fell from 100% to 51%, while foreign ownership emerged at 49%.

In 2016, Jollibee Foods Corp first announced plans to conduct an initial public offering (IPO) of the Highlands Coffee chain on the Vietnamese stock market.

According to Business Mirror, following the IPO, Jollibee was expected to increase its ownership in Highlands Coffee to 60%, while VTI would reduce its stake to 40%. With Jollibee holding more than 51%, the company managing the coffee chain would officially become a subsidiary of Jollibee. In return for this arrangement, VTI would receive an additional USD 30 million loan from JFC.

However, in July 2019, the transaction was postponed, with Jollibee declining to disclose the reason.

In June 2025, Mr. Tim Seltzer, Chief Financial Officer of Highlands Coffee, shared updates on the company’s IPO plan, stating that Highlands Coffee intends to list on the stock exchange within the next 18 to 24 months.