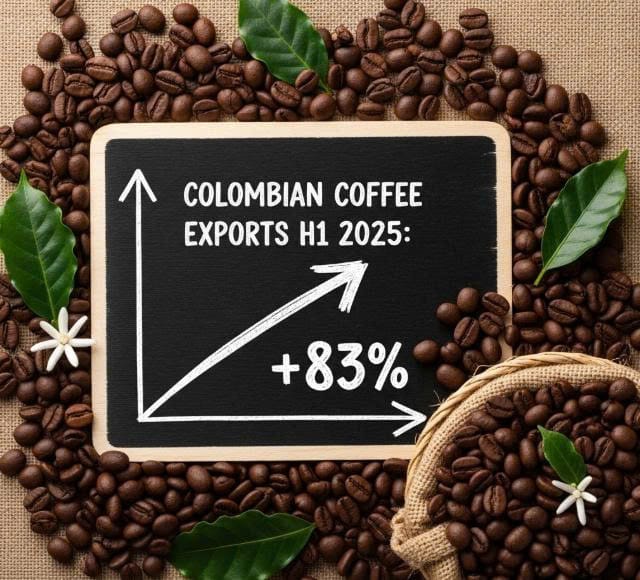

báo cà phê—Colombia’s coffee industry is enjoying a historic boost in 2025, with exports soaring by 83.3% in the first half of the year. According to the National Association of Foreign Trade (Analdex), sales climbed from US $1.464 billion in the same period of 2024 to US $2.683 billion this year, driven mainly by shipments to the United States, Germany, and Belgium.

Regional Performance: Huila and Antioquia Lead the Way

The surge in coffee exports has been widespread across Colombia’s main producing regions. Huila recorded a 67% increase, reaching US $581.5 million in sales, while Antioquia saw a remarkable 113.4% jump to US $504.8 million. Other top-performing coffee-exporting departments included Caldas, Quindío, Valle del Cauca, Risaralda, Santander, Magdalena, Cundinamarca, Nariño, Cauca, Cesar, Tolima, Atlántico, and Bolívar.

Javier Díaz Molina, president of Analdex, emphasized coffee’s central role in Colombia’s economic stability this year:

“Around 60% of the growth in the country’s agri-food exports is linked to coffee’s strong performance, which has helped offset the significant drop in mining and energy exports. The regions have been crucial in meeting this robust international demand.”

Industry Perspectives: Prices and Benefits for Producers

Gustavo Gómez, president of Asoexport, underscored the positive impact of high prices on the sector:

“Coffee is undoubtedly good news for the country. High prices have boosted foreign exchange earnings and directly benefited coffee-growing regions, as producers are receiving fair returns for their beans.”

In the first half of 2025, Colombia exported 353,289 tons of coffee, up 13.3% year-on-year. The main export ports were Buenaventura (65.5% of shipments), Cartagena (27.2%), and Santa Marta (6.9%). Major exporters included the National Federation of Coffee Growers, Olam Agro Colombia, Sucafina Colombia, Racafé, Sucden Colombia, Louis Dreyfus Company Colombia, Carcafé, and Condor Specialty Coffee.

Global Demand Soars

International demand for Colombian coffee has grown significantly. Exports to the United States increased by 81%, to Germany by 140.9%, and to Belgium by 103.1%. Other notable buyers included Canada, Japan, South Korea, China, Spain, and Australia.

In July 2025, the average base price for coffee purchases was COP 2,369,903, up 26% from last year’s COP 1,876,387. Coffee futures remained stable, starting the month at US $2.91/lb and ending at US $2.95/lb, while mild Arabica prices hovered around US $3.22/lb.

Chaparral to Host the 2026 International Coffee Fair

In another major development for Colombia’s coffee industry, Chaparral, in southern Tolima, has been chosen to host the 2026 International Coffee Fair—one of the most important events in the sector. The announcement was made by Tolima’s governor, Adriana Matiz, during this year’s edition of the fair in El Líbano.

The decision was met with excitement from Chaparral’s delegation, including Mayor Hélvert González Mora, who praised the teamwork transforming the region. The event is expected to boost the local economy, attract tourism, and strengthen Chaparral’s reputation as a premier coffee-producing area.

The International Coffee Fair annually brings together producers, experts, buyers, and coffee enthusiasts from across Colombia and abroad. It serves as a strategic platform to showcase Colombia’s rich coffee heritage, specialty beans, and sustainable farming practices.

A Strong Outlook for Colombian Coffee

The III International Coffee Fair in El Líbano demonstrated the rising interest in Colombia’s specialty coffees, highlighting the opportunities for small and medium-sized growers. With record-breaking export figures, expanding global demand, and the spotlight of the upcoming 2026 fair, Colombia’s coffee sector is poised for sustained growth—cementing its position as one of the world’s leading coffee powerhouses.